ATTORNEYS

PARTNER

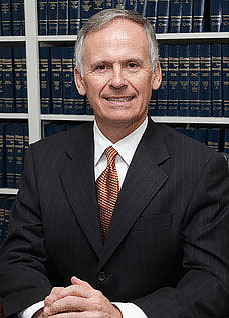

Neil Warner Yahn, Sr., is a partner in the firm of JSDC Law Offices. He also serves on the faculty at Villanova University as an adjunct professor where he teaches Individual Taxation and Taxation of Business Entities.

PARTNER

Edward P. (Ted) Seeber, a partner with JSDC Law Offices, is a graduate of the University of Pittsburgh at Johnstown.

KATHRYN L. MASON

PARTNER

Kathryn L. Mason, Katie, an attorney at JSDC Law Offices, is a general law practitioner with an emphasis on regulatory and transactional matters, including banking, real estate, commercial litigation, municipal law, insurance regulatory law, corporate transactions and real estate tax matters.

GARY L. JAMES

PARTNER (1950-2017)

Gary L. James, a Partner of the JSDC Law Offices, passed away on March 5, 2017. He is missed by his family, friends and colleagues.

LEADING MINDS. LATEST PUBLICATIONS.

Bernie Sanders’s Plan to “Progress” the Federal Estate Tax – Neil Yahn

An Estate Tax Exemption of $3.5M opens the door for critical planning and use of SLATS! https://www.accountingtoday.com/articles/sanders-proposes-estate-tax-of-up-to-77-for-billionaires [...]

Clawback Example

Prop. Regs. 20.2010-1(c); Reg-106706-1 If a client gifts $11.4M in 2019 and dies in 2026 when the exemption [...]

No Clawback – Easing Angst Among Tax Practitioners and Estate Tax Exemption of $11,400,000 in 2019 – Neil Yahn

I lectured for the PICPA on Friday 12/7/2018 and critical to that discussion was the current exemption of [...]

IRS Announces Higher 2019 Estate And Gift Tax Limits – Neil Yahn

The IRS announced the official estate and gift tax limits for 2019: The estate and gift tax [...]